Image

New Jersey residents pay some of the highest state taxes in the country. Morristown Minute recently published an article about Morristown, NJs Biggest Problems, where we identified areas in which Morristown Struggles significantly.

The results of our investigation showed a need for further state funding in the areas of criminal justice reform, affordable housing, and mental health care. But how much of our tax dollars are going to the places we need them?

What have NJ taxes been up to in the past couple of years?

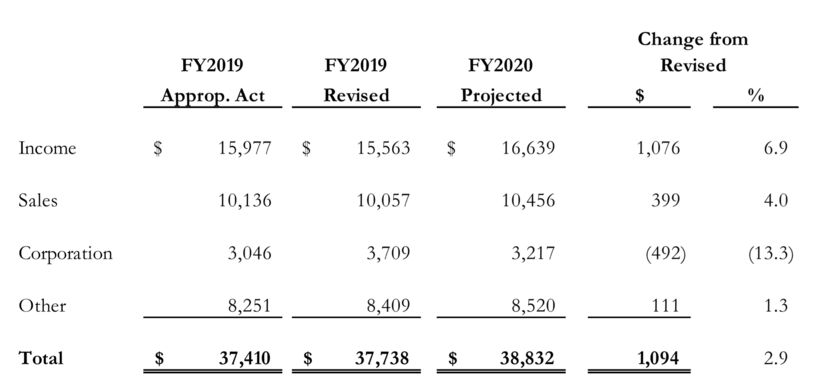

New Jersey taxes have risen across the board in all but one area. Income tax went up nearly 7% from 2019-2020, sales tax is up over 4%, with a total tax increase of 2.9%.

The only decrease in tax revenue for the state was in corporation tax, which dropped 13.3% from 2019-2020.

Close to 43% of New Jersey's 2020 budget was funded by income tax paid by New Jersey residents.

Significant portions of NJ taxes go to our state government, for things like corrections, public safety, the treasury department, environmental protection, agriculture, transportation, and more.

More money has been flowing into the departments of correction, law and public safety, treasury, and state services.

Meanwhile, less of your tax dollars are going towards environmental protection, agriculture, and transportation. As mentioned above, our investigation of NJs biggest issues showed a lack of adequate transportation and infrastructure. However, less of our tax dollars are going towards remedying these issues.

Schools, of which New Jersey has the best in the nation, saw a 3% increase in tax revenue from 2019-2020. There was an increase in aid to schools, at just under three percent.

Payment to teachers, which includes pension and annuity funds, post-retirement medical insurance, and social security, increased 3.2%.

Taxes to public higher education, listed separately from school and teacher aid, increased by 1.2% to help students with debt and financial aid. More money is going to students, meanwhile, less of that money is going to our public universities and colleges.

About 38 cents of each of your tax dollars go to education in the state of New Jersey.

15 cents of every dollar go to Human Services.

12 cents of every dollar go to state benefits, utilities, and property costs.

7 cents of every dollar go to the department of treasury.

Less than 1 cent of every dollar goes to agriculture, banking and insurance, environmental protection, labor, and military and veteran's affairs.

What has Morristown's Tax Rate been up to?

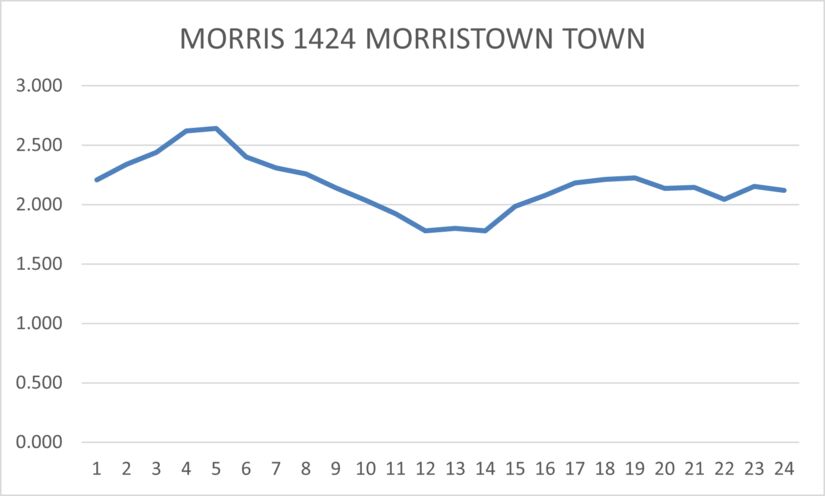

The above graph represents Morristown's tax rates over the last 24 years, from 1 - 1997 to 24 - 2020.

Our town's tax rate has been relatively steady. Residents are paying a lower rate today than we were 24 years ago in 1997.

On average (from 1997-2020), Morristown residents pay a tax rate of 2.165%.

In 2020 we paid taxes at a rate of 2.118%, a slight decrease from our 24-year average. Our tax rate has been lower than the 24-year average since 2016, indicating a decreasing trend.

Where do we need our tax dollars to go?

As mentioned above, our investigation of Morristown's key issues revealed our town needs greater financial support in the areas of environmental protection and infrastructure, criminal justice reform, affordable housing, and military and veteran's affairs and mental health services including addiction services.

However, tax revenue for nearly all of these services decreased from 2019-2020. Environmental protection funds decreased more than 10%, transportation funds decreased over 55%, and corrections saw a modest increase of 0.4%.

Where do you want to see your money being used? What issues are most important to you? Let us know in the comments below.

Sources:

NJs 2020 State Budget: https://www.nj.gov/treasury/omb/publications/20bib/BIB.pdf