Image

The COVID-19 pandemic’s disruption of labor markets was massive, but it had only a modest impact on peoples’ retirement timing, according to recently released data from the U.S. Census Bureau’s 2021 Survey of Income and Program Participation (SIPP).

The SIPP collected data on respondents’ labor force status in 2020, the first year of the pandemic. These data show modest pandemic-related effects on retirement. The share of respondents ages 55-70 who said they were retired dipped slightly from January to December that year.

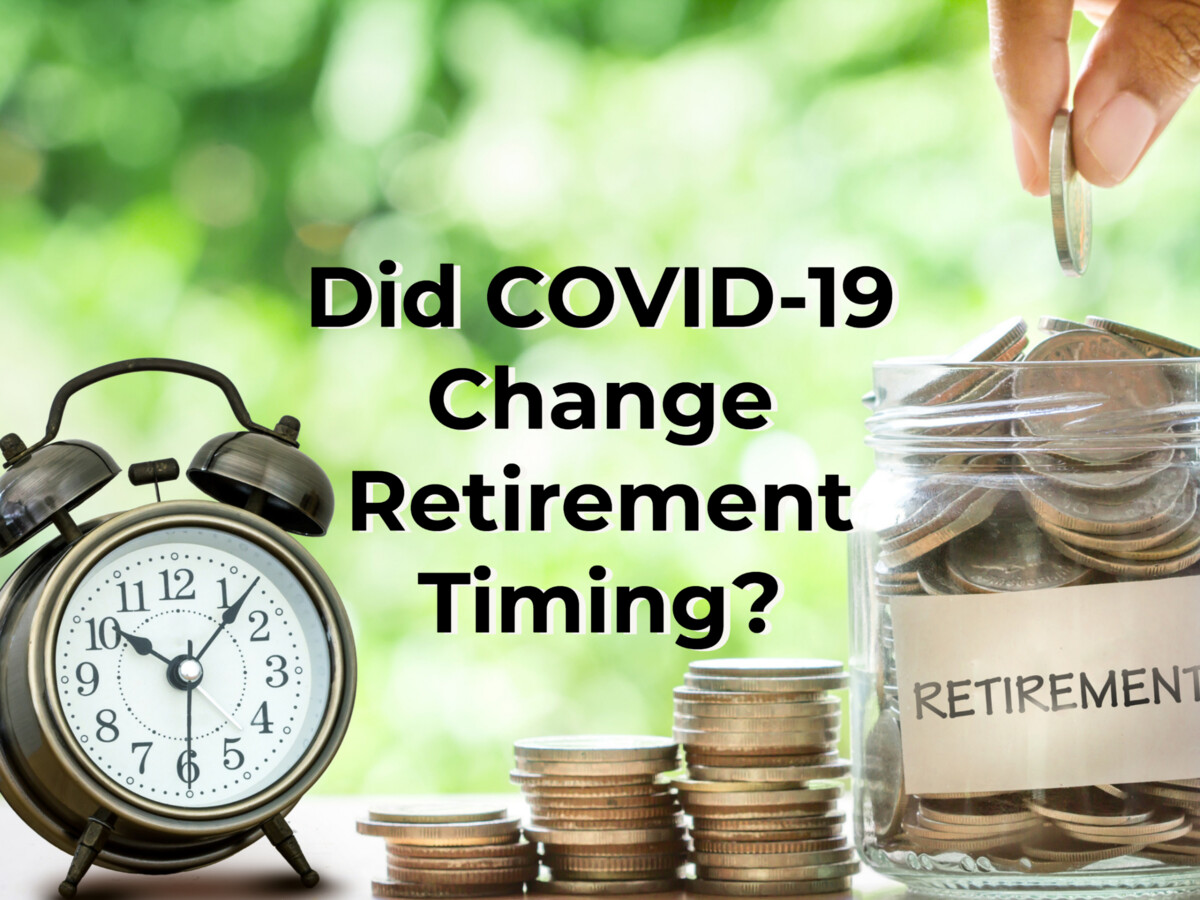

When asked how the pandemic affected the timing of their retirement, 2.9% of adults ages 55-70 employed in January 2020 said they retired early or planned to retire early due to the pandemic, while 2.3% said they either delayed or planned to delay retirement for the same reason.

Retirement trends were remarkably stable during a period of upheaval in the labor market overall.

Because of workplace shutdowns and demand shifts during the pandemic, unemployment increased from 3.5% in February 2020 to a peak of 14.7% in April 2020. Given the pandemic’s differential health effects by age, many speculated that the pandemic would also lead to mass retirement.

Retirement Patterns

The 2021 SIPP asked respondents about their employment and labor force participation during the previous calendar year — 2020. In contrast to other household surveys (which either collect annual data or whose sample composition varies throughout the year), SIPP collects monthly information about the same sample for the entire year.

The share of respondents ages 55-70 who reported retirement as their reason for not holding a job fell modestly from 29.4% in January to 28.2% by December.

There was no discernible change from January through the first several months of the pandemic.

Age, Health, Retirement

After the pandemic began, the Census Bureau added new questions to the 2021 SIPP that asked respondents how the pandemic affected them.

One question asked respondents ages 55 and older specifically how the coronavirus pandemic affected their retirement timing, or for those respondents who had not yet retired, their expected retirement timing. According to these reports, the changes were modest.

Among those employed in January 2020, the impact differed by age. Adults 62-65 years old reported the most changes, with 4.6% saying they had retired early or planned to retire early and 2.9% saying they had delayed or planned to delay their retirement.

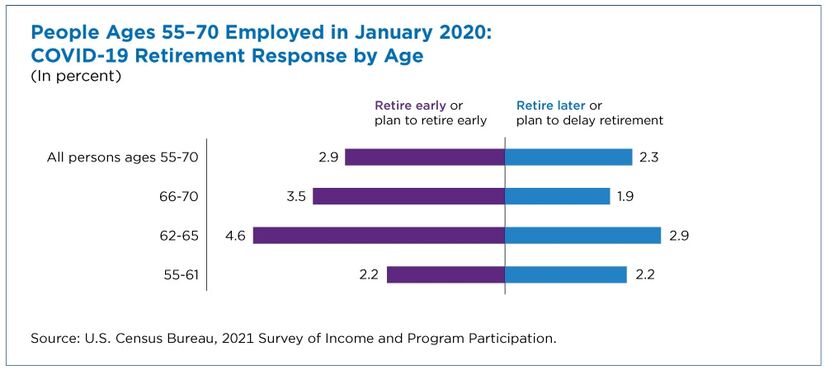

SIPP asked respondents to rate their health on a five-point scale: excellent, very good, good, fair, and poor. Changes to retirement timing in response to COVID-19 varied by the health rating respondents reported.

Those reporting poor health skewed toward early retirement: 5.6% reported that they had retired early or planned to retire early due to COVID-19 and 0.6% reported that they had delayed or planned to delay retirement.

Retirement timing differences for other values of self-reported health were not statistically significant.

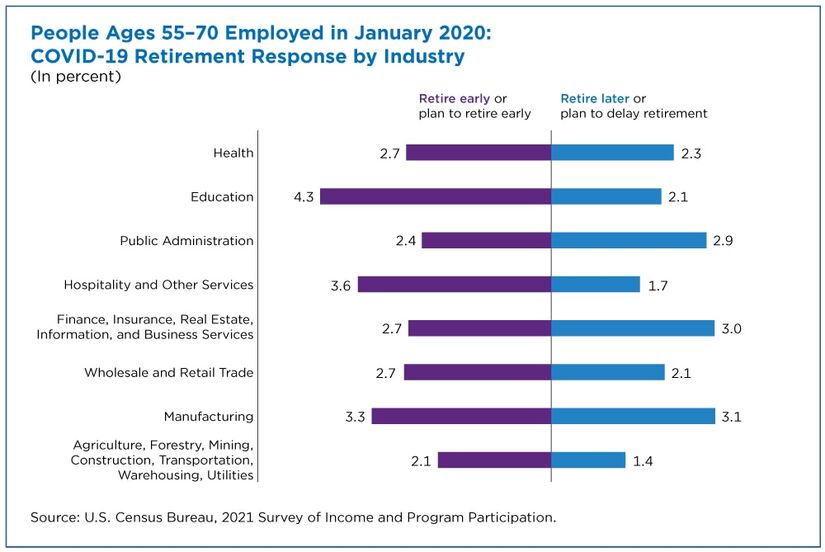

Retirement Timing by Industry

The pandemic had a major impact on jobs that require face-to-face interaction or cannot be performed remotely. It also contributed to considerable supply and demand shifts that affected employment patterns.

Did COVID-19’s impact on retirement timing affect people in some industries more than others? Again, the changes were modest.

Given the relatively small age group examined and the fact that some industries employ relatively few older people, it was necessary to collapse industry categories to a greater extent in this than in many other Census Bureau data products. Respondents can report multiple jobs in SIPP; the figure uses the first reported job for January 2020.

Among the findings:

Differences between early and delayed retirement were not statistically significant for other industry groups.

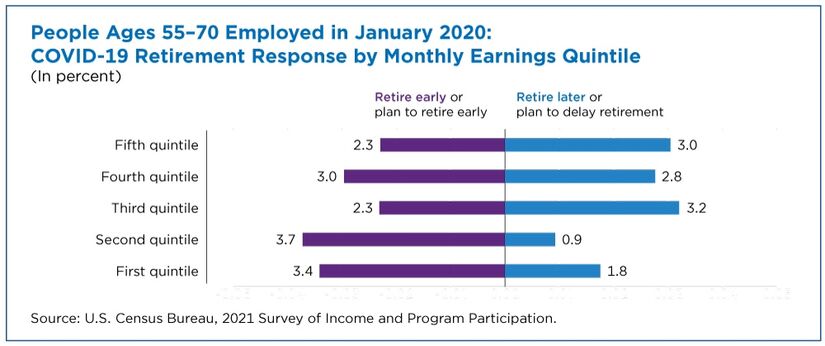

Earnings and Retirement Timing

Retirement responses to the COVID-19 pandemic varied somewhat by earnings, based on monthly earnings from wages, salary, tips, and self-employment in January 2020. SIPP respondents who earned the least were more likely to say that they moved up their retirement or planned retirement than that they delayed retirement.

Among the first quintile (the lowest earners), 3.4% said they planned to retire early compared to 1.8% who said they would delay retiring. In the second quintile, the difference was 3.7% and 0.9%, respectively.

Differences among higher earners (the third, fourth, and fifth quintile) were not statistically significant.

Article and Information Courtesy of The U.S. Census Bureau.

Morristown Minute has been approved for the 2022 Local News Fund!*

Our reporters will be dedicating time and resources to investigating the roadblocks to mental health accessibility in our town.

Donate to Morristown, NJs local mental health accessibility fund today!

Scan the QR code to donate!

Scan the QR code to donate!*The 2022 Local News Fund is a program administered by the Local Media Foundation, a 501(c)(3) organization affiliated with the Local Media Association. The purpose of the program is to allow independent and family-owned news organizations to solicit tax-deductible donations from their communities for journalism projects that focus on critical local issues. Contributions to this program are tax-deductible to the full extent of U.S. law; please consult a tax advisor for details.