Image

Like most things coming from the government, Medicare and Medicaid eligibility, requirements, premium determination, and available plans are far from self-explanatory or easily defined. Morristown Minute found that a majority of Medicare beneficiaries surveyed had little to no understanding of how their premiums were determined or what plans were available to them.

Morristown Minute also spoke with several mental health professionals in Morristown who revealed their frustration with the lack of Medicare available mental health professionals in our town. A quick search for Medicare available psychiatrists in Morristown reveals a stunning lack of options.

As a news organization, there is little we can do to remedy the lack of adequate mental health professionals available to Morristown Medicare beneficiaries. Therefore, we decided to do some digging into the basics of Medicare to further educate both beneficiaries and potential enrollees in our town.

Medicare is federal health insurance for people sixty-five and older, or younger people with disabilities, or people with End-Stage Renal Disease. Medicaid is a federal health insurance assistance program that serves any age of lower-income people and varies by coverage, like Medicare, from state to state.

For more information on the basics of Medicare visit http://www.medicare.gov/.

For more information on the basics of Medicaid visit http://www.medicaid.gov/.

In this article, we will focus on Medicare and the options available to beneficiaries.

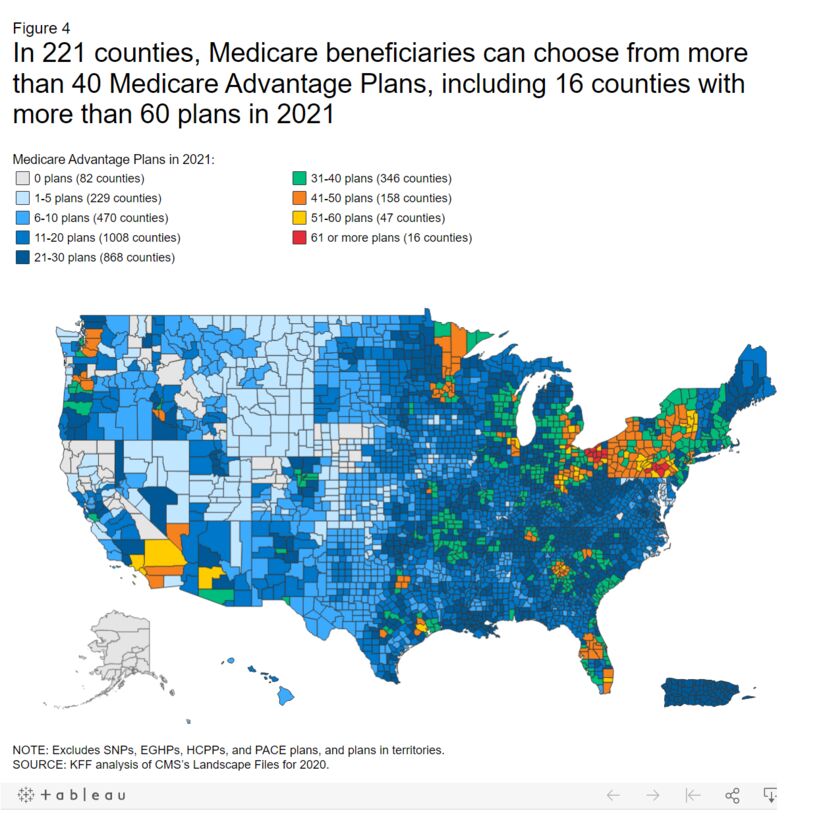

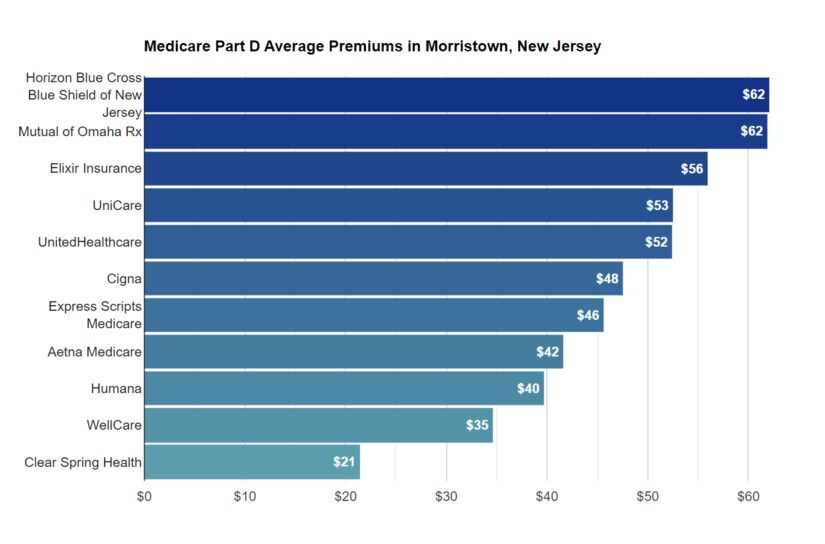

Source: KFF analysis of CMS’s Landscape Files for 2020.

Source: KFF analysis of CMS’s Landscape Files for 2020.Over 1.6 million New Jersey residents are covered by Medicare with 87% of them eligible due to their age (65+) and 13% eligible due to extended disability (a disability that lasts for more than 24 months).

Medicare members in New Jersey have anywhere from eleven to forty-three Medicare Advantage Plans to choose from as of 2020 depending on their county. The important takeaway here is that where you live determines the number of options you have for Medicare plans. Morris County, as of 2020, has 43 plans available.

Beneficiaries have two main choices when picking Medicare plans, Medicare Advantage, and Original Medicare. Medicare Advantage plans enroll beneficiaries in a private health plan that is under contract with the federal government to provide Medicare options. Original Medicare is a plan where the federal government covers the cost of medical care directly and has two main additions: Part A and Part B.

Original Medicare Part A plans help beneficiaries pay for inpatient stays at hospitals, skilled nursing facilities, or hospice centers. Part B plans help beneficiaries pay for outpatient care like doctor appointments or preventative health care services like some vaccinations.

Medicare Advantage Plans bundle parts A and B under one monthly premium and often include other services like prescription drugs and vision coverage.

Most beneficiaries in New Jersey are enrolled in Original Medicare, but Medicare Advantage enrollment has been rising since 2004. Comparably, Medicare Advantage is less popular in NJ than the rest of the nation with about 22% of NJ beneficiaries enrolled in Medicare Advantage compared to 34% of beneficiaries enrolled in Medicare Advantage throughout the nation.

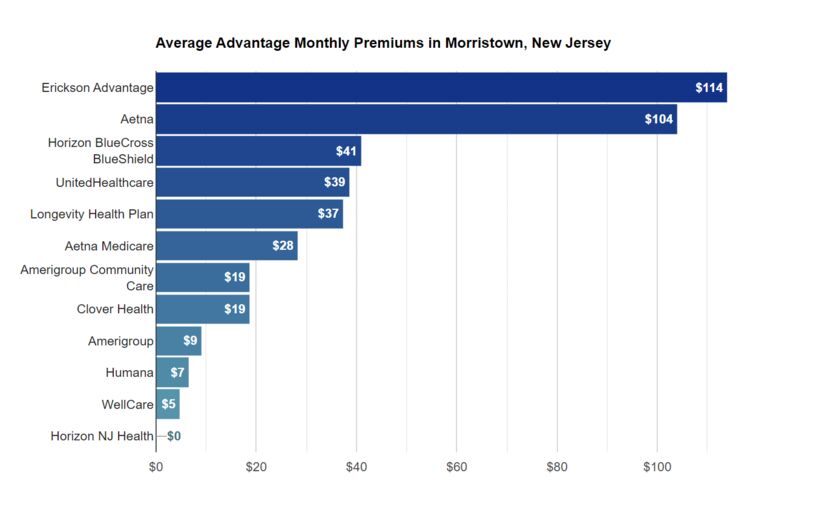

Average Monthly Premium Cost per Plan

Average Monthly Premium Cost per PlanIn Morris County, there are 43 available Medicare Advantage Plans as of 2020. Over half of Medicare beneficiaries in NJ have stand-alone Part D Plans (Part D covers prescription drugs) and have 28 Part D plans to choose from as of 2020 with monthly premiums ranging from $13 to $116.

Enrollment for Medicare begins when a person first becomes eligible or during the open enrollment period which happens every year from October 15th

to December 7th. Those already enrolled in Medicare Advantage have an open enrollment period every year from January 1st to March 31st when beneficiaries can change their Medicare Advantage Plan or switch to Original Medicare.

The main topic of concern for enrollees is the cost of premiums. Premium payments are based on several factors, all of which have been standardized by the Affordable Care Act. The Affordable Care Act made it so that insurers are only allowed to calculate premiums for federal health insurance by considering three factors: age, smoking status, and rating area.

Rating area essentially means the area you live in; however, this is not always as clear as it sounds. The Affordable Care Act required that each U.S. state divide itself into groups made up of either county, metropolitan statistical area, or three-digit zip code. When insurers price premiums, everyone within a specific rating area will have the same adjustment factor applied. Therefore, the area in which you live has a significant impact on the premium price you pay.

The rating area is determined by the projected cost of Medicare patients in that area including the cost of service providers, amount of coverage available in the area, number of Medicare members in the area, and your location's demographics. Here it is important to note that environmental conditions, disease outbreaks (i.e., COVID-19), and other location-based factors determine your premium payments for Medicare plans.

Insurers are not required to offer statewide plans and therefore some areas of residence may have more or fewer options than what is typical of the state of New Jersey.

Rating area is not clearly defined on federal websites, nor is it clear how the rating area directly impacts your premium payments; the federal websites fail to detail how rating area correlates to dollar amounts.

One of the most important things to know is that more insurers in your rating area competing for your business leads to better premium prices than in areas where there are few options. However, competitors will avoid entering counties where there are many Medicare options to avoid excess competition, therefore if you live in a county like Morris, your premium prices will likely not change much in a good way (i.e., they won’t go down).

Another consideration for rating area comes from the three main impacts on overall health as determined by the CDC. The CDC states that the three main impacts on our health come from one’s income, employment conditions, and education and literacy. Although insurers offering Medicare can not alter individual premiums based on any of the above factors, the rating area takes into account the environmental impact on one’s health based on where one lives. Therefore, more polluted parts of the country will see higher premiums on average.

Once qualified for Medicare, there are a lot of plans and options to choose from. We’ve explained Medicare Advantage, Original Medicare, and parts A and B. There are many more plans to consider and a full list with reviews can be found here. However, we will shift focus to Medigap Plans and Medicare Part D.

Average Monthly Premiums per Part D Plan

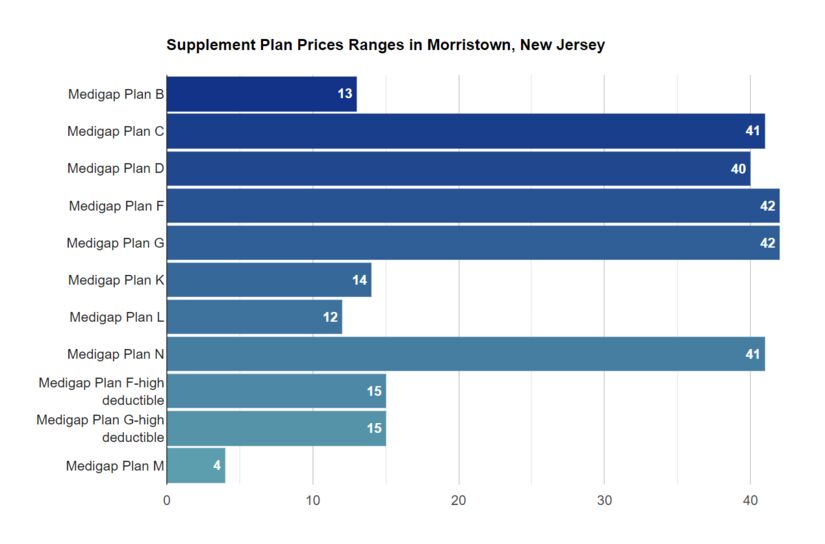

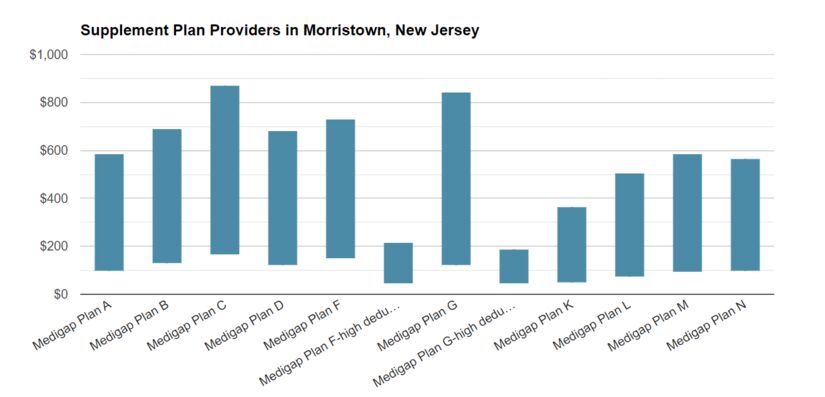

Average Monthly Premiums per Part D PlanMedigap Plans are used to supplement Original Medicare and cover some or all out-of-pocket costs. Twenty-seven insurers in New Jersey offered Medigap Plans in 2020, these plans are available to anyone 65 and older and allow potential enrollees a six-month window for those enrolled in Medicare Plan A and B when coverage is a guaranteed issue for Medigap Plans.

It is important to note that Medigap Plans are not guaranteed for those under 65 who are enrolled in Medicare. New Jersey, however, follows the majority of states in the nation to ensure some Medigap access to enrollees under 65. NJ also ensures that enrollees under 65 with access to Medigap plans do not pay premiums higher than those 65 and older for Medigap coverage. However, not all states have this guarantee. In New Jersey, Medigap coverage for those under 50 is a guaranteed issue only for the state of New Jersey’s contracted carrier, Horizon Blue Cross Blue Shield of New Jersey.

Supplemental Plan Price Ranges for Morristown, NJ

Supplemental Plan Price Ranges for Morristown, NJNew Jersey balances the financial losses of expanding Medigap coverage by running a program that spreads those losses across all carriers in the state. Because of this, for enrollees 50 to 64 and disabled beneficiaries, Plan D (covers cost of Rx) coverage is a guaranteed issue with any Medigap-offering insurer (prior to 2020 Plan C was the guaranteed issue).

As of mid-2020, there were 898,207 Medicare beneficiaries enrolled in stand-alone Part D prescription drug plans in New Jersey. In 2019 that number was over 913,000, indicating a decrease due to rising enrollment in Medicare Advantage Plans, most of which bundle in Part D prescription drug coverage. In total, Medicare Part D enrollment in NJ as of mid-2020 was over 1.236 million and increasing.

In 2020, of the 27 insurers offering Medigap plans, there were 28 stand-alone Part D plans available to NJ beneficiaries with monthly premiums ranging from $13 to $116. In 2018, NJ Original Medicare spent an average of $10,793 per enrollee. Comparably, the national average in 2018 per enrollee was $10, 096, 7% lower than what NJ spent on its Medicare beneficiaries. The highest cost per person in the country comes from Louisiana where Original Medicare spent $11,932 per person in 2018. The lowest cost in the nation per person enrolled in Original Medicare came from Hawaii at $6,971.

To find more helpful information on what plans are available in Morristown, what our rating area is (Rating Area 1), and how to choose a plan and determine eligibility visit one of the helpful websites below.

Helpful sources:

https://www.state.nj.us/humanservices/doas/services/ship/

https://www.state.nj.us/nj/community/senior/

https://libguides.njstatelib.org/get_help/seniors

https://www.state.nj.us/humanservices/doas/documents/SHIP_Advantage_Plans2021.pdf

Article Sources:

https://www.healthinsurance.org/medicare/new-jersey/

https://www.expertinsurancereviews.com/morristown-new-jersey-medicare-companies/

https://www.kff.org/medicare/issue-brief/medicare-advantage-2021-spotlight-first-look/

https://www.morriscountynj.gov/Departments/Temporary-Assistance/Apply-for-Medicaid

https://www.valuepenguin.com/what-aca-insurance-ratings-area

https://www.hhs.gov/guidance/document/questions-and-answers-related-health-insurance-market-reforms

https://www.cms.gov/CCIIO/Programs-and-Initiatives/Health-Insurance-Market-Reforms/state-gra

https://www.cms.gov/CCIIO/Programs-and-Initiatives/Health-Insurance-Market-Reforms/nj-gra

https://www.state.nj.us/humanservices/doas/documents/SHIP_Advantage_Plans2021.pdf