Image

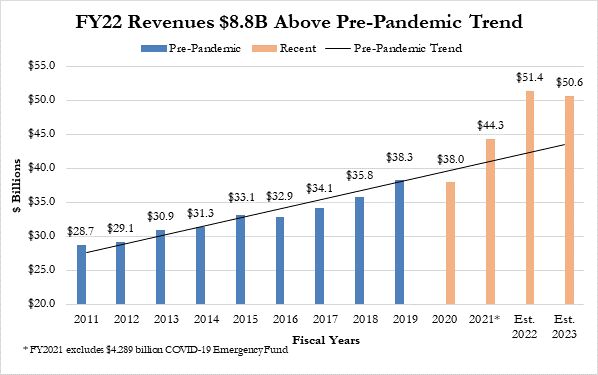

The NJ Department of Treasury reported that “the State’s fiscal picture is remarkably strong,” citing rapid revenue recovery last year, followed by the continued revenue surge this year.

From a low of $38 billion in FY2020 when the pandemic hit, State revenues have begun to soar to an estimated $51.4 billion in FY2022 – a $13.4 billion jump, up 35.3% in only two years, an unprecedented surge for the state of New Jersey.

In comparison, after the Great Recession it took the State of NJ seven years to return to the pre-recession revenue peak. Today NJ hasn’t just returned to the pre-pandemic peak but soared $8.8 billion above the pre-pandemic trend line.

NJs revised FY22 revenue forecast of $51.4 billion is $4.5 billion above the state’s early March forecast

The state’s FY23 revenue forecast of $50.6 billion is $3.3 billion higher than the March forecast

NJs combined two-year forecasts are $7.8 billion higher than the state’s two-year forecasts from just a couple of months ago. Additionally, the combined two-year forecast is also some $4.7 billion above the April forecast made by colleagues at the Office of Legislative Services (OLS).

The combined two-year forecast is now $919 million above OLSs revised forecast - $452 million higher in FY22 and $467 million higher in FY23.

So, what happened?

According to the OLS, the federal government as well as a number of states, including New Jersey, saw huge spikes in April tax payments.

The best explanation for the jump in revenue is likely related to the boom in financial markets and the overheated economy over the past 12 months.

According to David Drescher, section chief of revenue, finance, and appropriations at OLS, “retail investment gains, mergers and acquisitions, and conventional capital gains are all high…In light of the dive in stock markets since the start of the year, we should not expect this kind of revenue gain to continue."

According to the NJ Department of Treasury, “most of the upward revenue revisions are due to very strong collections in March and April from PTBAIT – the Pass-Through Business Alternative Income Tax – and the Gross Income Tax (GIT)."

Combined, these two revenue streams account for $6.2 billion of the upward revision over the two fiscal years. About 1/3 of PTBAIT revenue came from new taxpayers who have never paid PTBAIT previously.

The state’s forecasts for a number of other revenues are also up $1.6 billion over the two fiscal years.

Some highlights over the combined FY22-23 include:

According to the NJ Department of Treasury, most of this tax revenue surge is driven by the very strong year taxpayers had in 2021.

Last year was a record year for New Jersey’s labor market, as 212,400 jobs were restored and created. Moreover, through the end of March 2022, the State of NJ has recovered 92.7% of the jobs lost at the onset of the pandemic, and the unemployment rate has fallen back to 4.2%.

In 2021, wages and salaries rose 8.4% and State nominal GDP climbed 8.7%. Boosted by rising incomes and federal stimulus payments, retail sales soared 20.5% according to Moody’s. Additionally, New Jersey’s housing market continued to grow, and single-family home prices rose 14.4%.

Nationally, corporate profits jumped an estimated 36% in 2021, the S&P 500 index rose 26.9%, and Wall Street bonuses were up 20%.

But NJ is not alone, New York State recently closed its FY21-22 with 33% higher revenues than they forecasted – up $30 billion. Reports are also trickling in from many other states of unexpectedly strong April revenue collections. For example, Pennsylvania reported beating its April tax revenue target by $1.8 billion, and that they are $4.5 billion ahead of its year-to-date target.

But this revenue surge also comes with warnings!

A long-time expert on state revenues, the Urban-Brookings Tax Policy Center’s Lucy Dadayan says states are in a “fiscal bubble” and that current collection patterns are not sustainable.

For the year to come, the NJ Department of Treasury agrees that the current growth is unsustainable, and therefore the state’s FY23 forecast is down 1.6% from FY22. NJ Treasury also sees Sales Tax growing more slowly by 2%.

On the other hand, NJ Treasury anticipates declines in the GIT, CBT, PTBAIT, Inheritance Tax, and the Realty Transfer Fee.

“New Jersey is benefitting from a remarkable two-year revenue rise. We have achieved, at least for now, some structural balance between revenues and expenditures. We have dedicated a significant amount to debt reduction to improve the State's long-term fiscal conditions.” – NJ Department of Treasury

With extra revenue at its disposal, NJ Treasury now aims to fix the underfunded State pension system, substantially increase property tax relief through the new ANCHOR program, deliver record amounts of school aid, and build up a vital surplus to help cushion the State for emergencies and future negative downturns.

“We are in a very good place today, better than anyone could have hoped for 24 months ago. This is a good problem to have, but it will clearly serve as a temptation. We have to be cognizant of the economic news coming in on a daily basis.” – NJ Department of Treasury

“The wealthy had a very good year, thanks to skyrocketing corporate profits across the globe last year, and this is reflected in our income tax revenues. On the opposite side of the coin, we've seen an increase in requests for assistance from our most vulnerable.” – NJ Department of Treasury

Follow Morristown Minute on Facebook, Instagram, and Twitter for more local and state updates.