Image

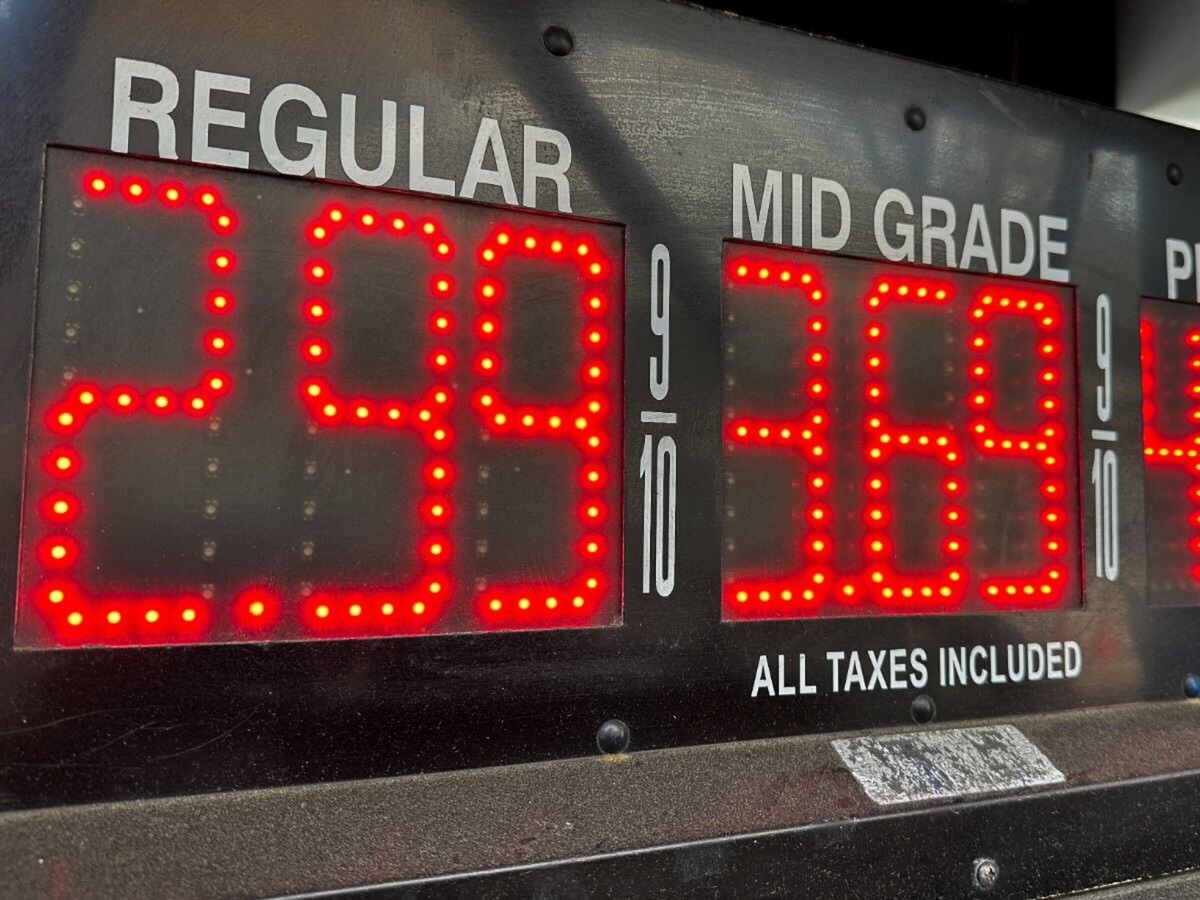

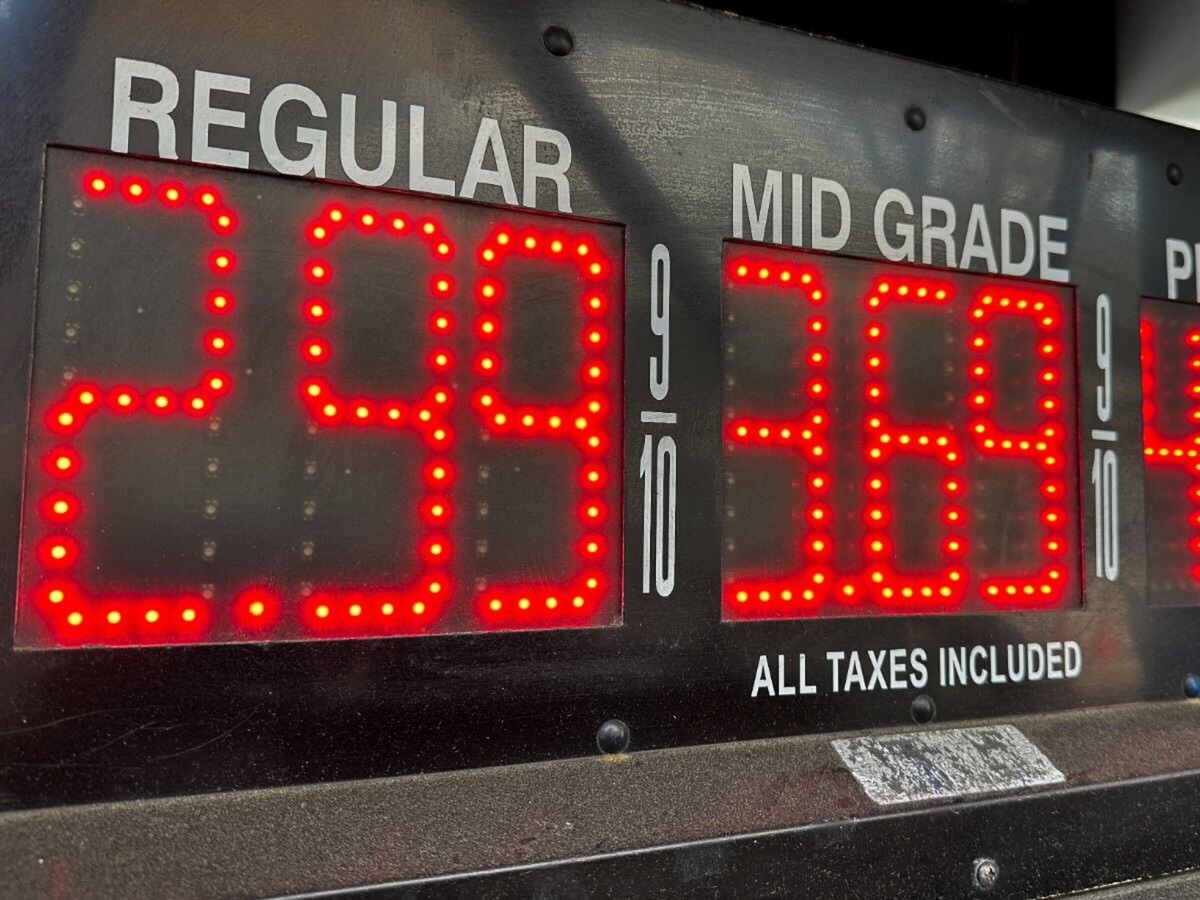

TRENTON, NJ — New Jersey motorists will see a 4.2-cent increase in the state gas tax beginning January 1, 2026, as part of a scheduled adjustment under the Transportation Trust Fund (TTF) law enacted in 2024. The increase, announced by the Department of the Treasury on December 2, is designed to meet statutory funding requirements for infrastructure improvements.

With this change, the combined gas tax rate will rise to 49.1 cents per gallon for gasoline and 56.1 cents per gallon for diesel, including both the Motor Fuels Tax and the Petroleum Products Gross Receipts Tax (PPGRT). The Motor Fuels Tax remains unchanged at 10.5 cents for gasoline and 13.5 cents for diesel. The PPGRT rate, however, will increase from 34.4 cents to 38.6 cents for gasoline, and from 38.4 cents to 42.6 cents for diesel fuel.

This marks the largest annual increase since FY 2021, when the tax rose by 9.3 cents, as shown in historical data released by the Treasury (see image below).

“Due to the new statutory target, and because actual consumption has trended below last fiscal year’s levels, our analysis of the new formula dictates a 4.2 cent increase this coming January,” said State Treasurer Elizabeth Maher Muoio. “We emphasize that this dedicated funding stream continues to provide billions of dollars across the State to support our critical transportation infrastructure needs.”

The rate adjustment stems from P.L.2024, Chapter 7, which raised the Highway Fuel Cap—the annual revenue target the state must meet from fuel taxes—beginning in Fiscal Year (FY) 2025 and continuing through FY 2029. The FY 2026 cap is set at $2.115 billion, a 4.1% increase over the prior baseline of $2.032 billion.

Additionally, because revenue collections in FY 2025 fell short by $23.8 million, the total revenue requirement for FY 2026 is $2.139 billion. At the same time, fuel consumption is projected to decline by 1.0%, necessitating a rate increase to ensure the state meets its statutory revenue target.

The “gas tax” is composed of two parts:

Motor Fuels Tax – fixed per gallon.

Petroleum Products Gross Receipts Tax (PPGRT) – variable and subject to annual adjustment.

Under the law, the PPGRT is recalculated each fiscal year based on:

Revenue surpluses or shortfalls from the previous fiscal year.

Projections of current-year fuel consumption.

If revenues fall short or consumption declines, the PPGRT increases to meet the required cap. If revenues exceed targets or consumption is higher, the rate may be lowered.

The annual rate-setting process includes a formal consultation between the State Treasurer and the Legislative Budget and Finance Officer by November 15 each year. This year's consultation concluded in November 2025, leading to the newly announced rate adjustment.

Since the implementation of the annual adjustment formula, New Jersey has seen five increases, two decreases, and two years of no change in the gas tax rate. The 2026 increase follows a smaller 2.6-cent increase in 2025, reflecting the new cap schedule established by Chapter 7.

The gas tax adjustments are part of a broader five-year plan to generate nearly $11 billion for the Transportation Trust Fund, which finances maintenance and improvements of New Jersey’s roads, bridges, and mass transit infrastructure. The cap will continue to increase each year, reaching $2.366 billion by FY 2029.

For more information on fuel tax rates and the Transportation Trust Fund, residents can visit the New Jersey Department of the Treasury or the Division of Taxation websites.

Want to understand the news better? Go to TheMinuteman.org to get simple explanations of the trending topics in the news.