Former Commodities Trader Sentenced to More Than 12 Years in Federal Prison for $4M Fraud Scheme

A former commodities trader from Chicago has been sentenced in Newark federal court to more than 12 years in prison for orchestrating a multi-million-dollar wire and commodities fraud scheme that victimized more than a dozen investors across the country.

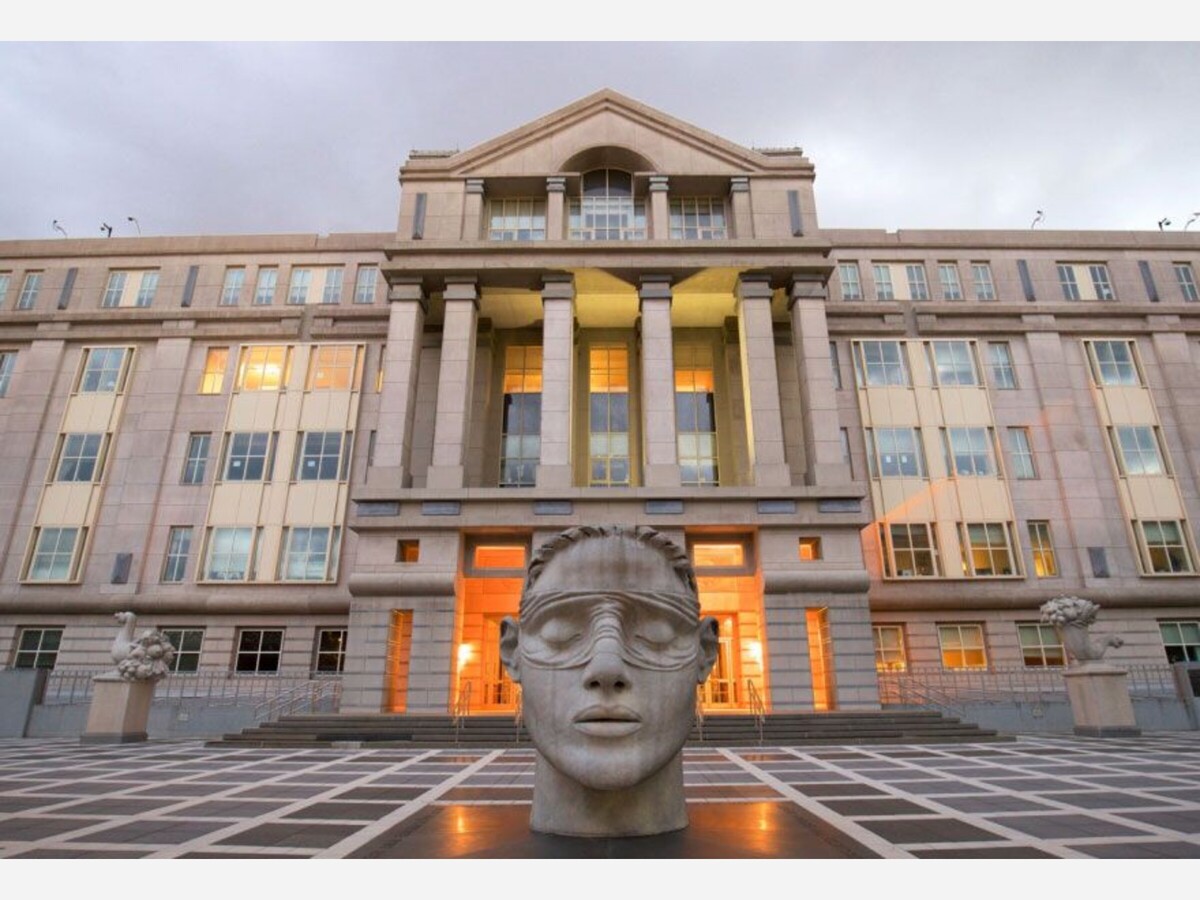

Philip Galles, 59, of Chicago, Illinois, was sentenced on Feb. 5, 2026, to 151 months in prison and five years of supervised release, according to an announcement from Senior Counsel Philip Lamparello. Galles was also ordered to pay more than $4 million in restitution to victims. The sentence was imposed by Esther Salas in the U.S. District Court in Newark. At the conclusion of the hearing, Galles was remanded into the custody of the U.S. Marshal to begin serving his sentence.

Galles previously pleaded guilty to an indictment charging him with wire fraud and commodities fraud.

Scheme Centered on False Investment Claims

According to court documents and statements made during proceedings, Galles defrauded investors by claiming he would invest their funds in commodity futures through his purported Chicago-based firm, Tyche Asset Management. Prosecutors said Galles and others working with him falsely represented that the firm had a strong track record and used proprietary trading strategies capable of generating extraordinary annual returns exceeding 100%.

In reality, authorities said Galles made little to no legitimate investments. Instead, Tyche Asset Management was operated as a Ponzi-style scheme, with funds from new investors used to pay earlier investors and to cover Galles’ personal expenses. Those expenses included luxury clothing, rent on a high-end apartment, and luxury vehicles.

Undercover Meetings in New Jersey

During the federal investigation, Galles met in New Jersey with an undercover agent posing as an investment manager seeking to make a substantial investment. Prosecutors said Galles repeatedly made false statements during those meetings, including claims that his firm achieved annual returns of 336 percent, raised more than $2 billion within 60 days of launching, and counted a Kuwaiti sovereign fund and a prominent professional sports team owner among its investors.

Galles also falsely claimed to have graduated from a well-known Midwestern university, according to court records.

Agencies Involved

Senior Counsel Lamparello credited investigators from the United States Attorney’s Office, working under Acting Special Agent in Charge Matthew Maltese in Newark, along with inspectors from the United States Postal Inspection Service, led by Inspector in Charge Christopher Nielsen.

Additional assistance was provided by the Commodity Futures Trading Commission and the National Futures Association.

The government was represented by Assistant U.S. Attorney Carolyn Silane, chief of the Economic Crimes Unit, and Andrew Kogan of the Cybercrime Unit, both based in Newark.

Federal officials said the sentence reflects the scope of the fraud and the significant financial harm inflicted on victims.