Image

The New Jersey Department of Community Affairs (DCA) today issued the report “Buying New Jersey: The Rise in Institutional Ownership of Residential Properties,” which examines the recent rise in institutional homeownership and its impact on the ability of New Jersey residents to buy a home.

The report, researched and written by DCA’s Office of Policy and External Affairs, finds that an increasing share of the state’s housing stock is shifting to institutional ownership.

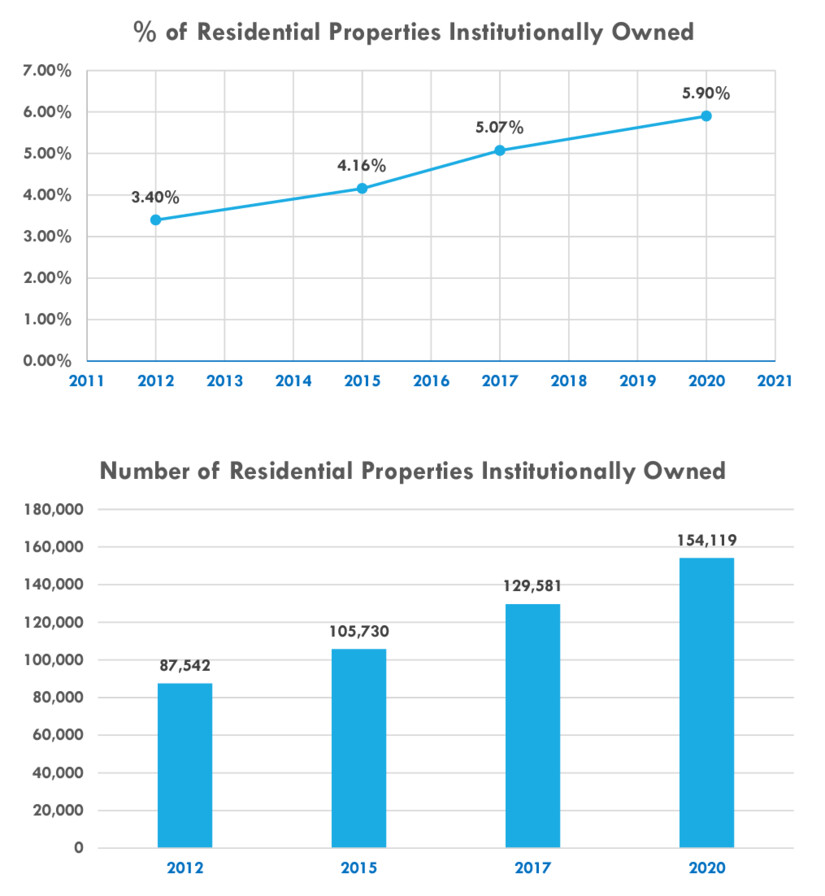

“Approximately 6% or 1 in 17 residential properties were institutionally owned in 2020, a 2.5 percentage point increase over 2012. The number of these properties nearly doubled over that eight‐year period.” – NJ DCA Institutional Homeownership Report, page 6

An increasing number of institutionally owned residential properties has driven up home prices while simultaneously taking more homes off the market.

“The…results reveal a positive relationship between the percentage of residential properties that are institutionally owned and the five-year change in the average sales price. A one percentage point increase in the share of institutionally owned properties increases five‐year sales price growth by $7,891.” – NJ DCA Institutional Homeownership Report, page 3

In other words, more institutionally owned homes in NJ equals higher home prices in NJ – for two reasons: institutionally owned homes have a higher resell price than family-owned homes, and they are more likely to undergo significant remodeling into apartment-style living effectively removing the property from the residential market.

“This report shows the challenges that exist for homebuyers, particularly those with lower incomes, to purchase a home in their communities when they’re competing against corporations and business entities for housing,” said Lt. Governor Sheila Oliver, who serves as DCA Commissioner. “While institutional homeownership is just one of several factors contributing to the very difficult housing market for regular homebuyers, it is an important factor. Therefore, we hope the report can be a starting point that leads all levels of government in New Jersey to find ways to make sure homeownership remains accessible to low- and moderate-income residents.”

In the last decade, 544 municipalities, or 96.4 percent of NJ municipalities, have seen increases in the share of residential properties owned by institutions such as corporations, business entities, trusts, and banks, which suggests this statewide trend is not abating.

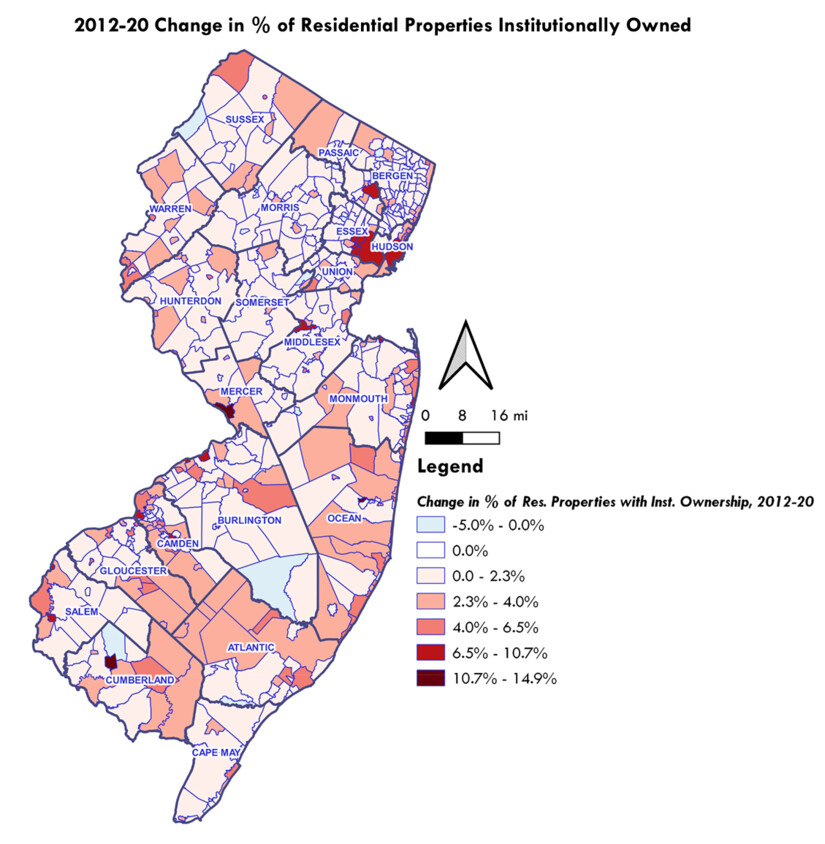

While the overwhelming majority of municipalities are experiencing a rise in institutional homeownership, the report finds the areas most targeted by institutional buyers tend to be lower income, more “distressed,” and have a resident population consisting mostly of renters. The report states that this “may reflect a propensity to acquire property for speculation, investment purposes, or to rent out.”

A recent report by the Rutgers Center on Law, Inequality and Metropolitan Equity (CLiME) revealed a dramatic rise in the sale of residential properties to corporate buyers within the city of Newark from 2017 to 2020, accounting for over 47% of the city’s one to four-unit residential buildings.

Research by the National Association of Realtors shows that the trend is national, noting institutional purchases accounted for 13.2% of home purchases in 2021, up from 11.8% in 2020.

A rise in institutional homeownership can limit the number of homes available to residential homebuyers in a community and make the remaining homes more expensive. Moreover, it can contribute to falling property values when absentee owners and landlords fail to properly maintain their properties.

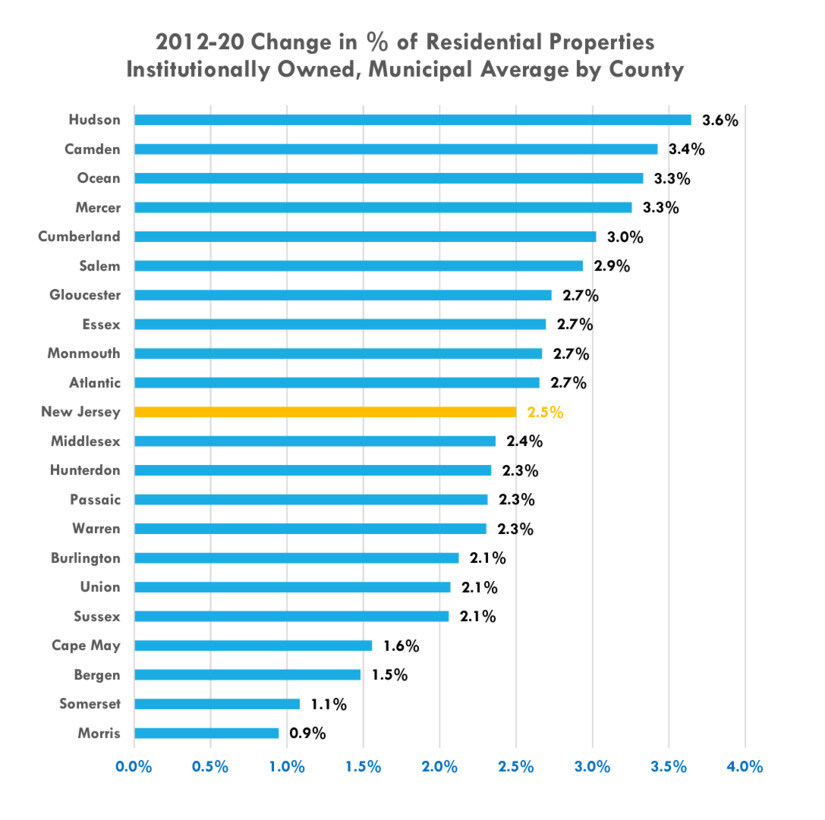

By region, southern NJ has seen the most dramatic rise in institutional homeownership, with a +2.7% increase between 2020-21. Meanwhile, northern NJ had a more modest increase of 1.9% between 2020-21. However, breaking the trend down by county paints a clearer picture.

Some recommendations to possibly address the institutional homeownership trend are offered in the report including:

Our reporters will be dedicating time and resources to investigating the roadblocks to mental health accessibility in our town.

Donate to Morristown, NJs local mental health accessibility fund today!

Scan the QR code to donate!

Scan the QR code to donate!*The 2022 Local News Fund is a program administered by the Local Media Foundation, a 501(c)(3) organization affiliated with the Local Media Association. The program’s purpose is to allow independent and family-owned news organizations to solicit tax-deductible donations from their communities for journalism projects focusing on critical local issues. Contributions to this program are tax-deductible to the full extent of U.S. law; please consult a tax advisor for details.